Note: This report focuses on cap rates and market trends for the Greater Vancouver area. The Chilliwack commercial real estate market tends to follow similar trends due to regional economic influences, investor activity, and tenant demand. While specific local variations exist, the insights provided here are generally applicable to Chilliwack as well.

Industrial, Retail, and Office Breakdown

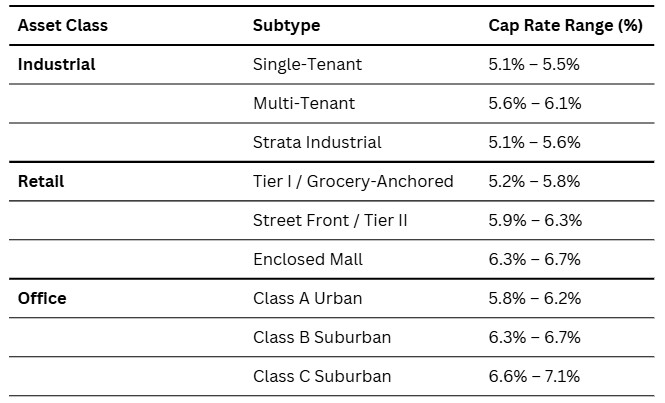

Q4 2025 Cap Rate Snapshot:

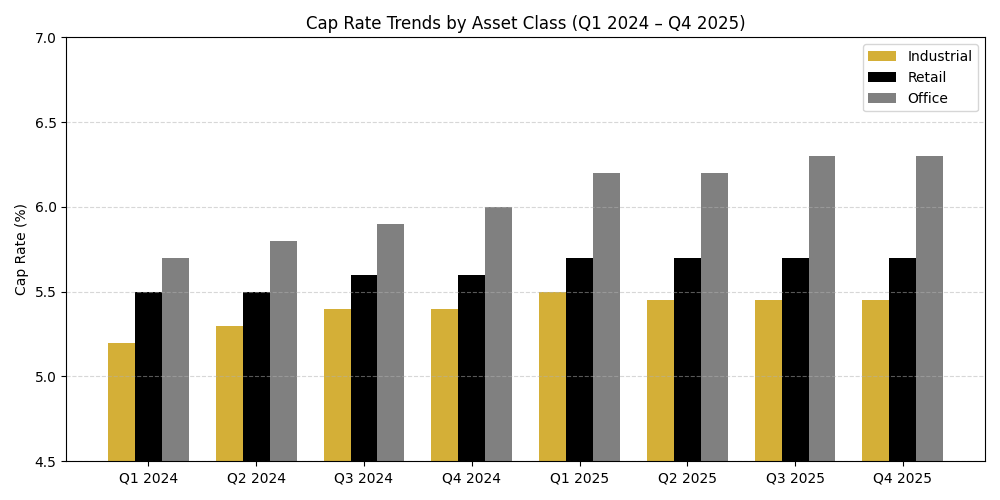

Cap rates across all major asset classes remained broadly stable in Q4, signaling that the market has found its footing after the turbulence of the past two years. Investors showed cautious optimism as interest rates eased, but there was no significant cap rate compression yet – pricing levels held near Q3 values. Industrial assets continued to demonstrate the most resilience, retail performance remained split (strong for essential retail, weaker for secondary locations), and office valuations stayed under pressure despite early signs of stabilization in top-tier properties.

Industrial

Cap rates remained flat in the mid-5% range, extending the stability seen since Q2.

Investor interest stayed strong for small-bay and single-tenant logistics assets, especially with long-term leases.

While demand persisted, some buyers flagged oversupply concerns in strata industrial heading into 2026.

National availability held at ~6.3%, with new completions balanced by healthy absorption.

Select institutional capital returned for premium assets, holding yields near Q3 lows

Office

Suburban office cap rates stayed elevated (mid-6% to 7%+), with limited buyer activity for B/C product.

Downtown Class AA and newer A-grade assets in Vancouver began to see renewed investor interest and mild cap rate compression.

Tenant decision-making remained cautious, but 'flight to quality' continued, favoring efficient, ESG-aligned space.

Landlords in secondary locations offered deeper concessions to maintain occupancy.

Overall, office valuations appear to have bottomed out — but meaningful recovery is still expected to trail into 2026.

Retail

Grocery anchored retail held firm, with some compression observed in fully stabilized centres. Food anchored strip malls remained a top investor target nationally.

Leasing incentives became more common in Tier II locations as landlords responded to increased tenant churn.

Investor appetite continued to diverge: Tier I remained in demand; Tier II faced pressure on NOI and pricing.

Most cap rate movement occurred at the margin — lower for food-anchored, higher for aging or non-anchored strips.

New construction remains limited, supporting pricing for well-leased assets.

Buyer and Seller Activity

Investor activity in Q4 showed modest improvement as confidence gradually returned. Private buyers and owner-users continued to drive most transactions, targeting strata industrial units and necessity-based retail for their reliable cash flow and accessible pricing. Institutional investors remained selective, re-engaging only for stabilized, core assets.

On the sell side, well-leased properties generally held value, while underperforming assets — such as partially vacant offices and secondary retail — saw more flexibility on pricing. With interest rates stabilizing and expectations becoming more realistic, bid-ask spreads narrowed, helping facilitate more deals as the year closed.

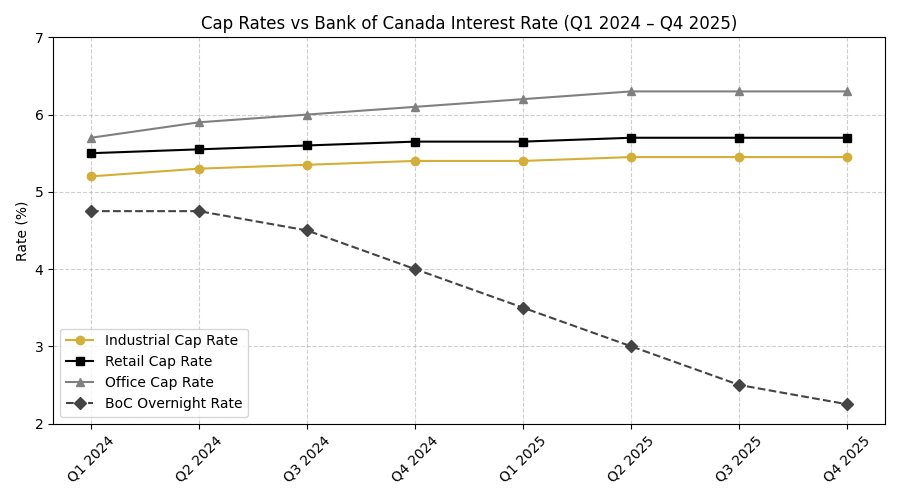

Cap Rates vs. Bank of Canada Interest Rates

The Bank of Canada cut the overnight rate to 2.25% in October 2025. However, cap rates held steady across most sectors despite cheaper debt, indicating a market driven more by asset fundamentals. Future cap rate compression is expected to be gradual and limited to prime asset classes.

Conclusion

The Q4 2025 commercial market in Chilliwack reflects a cautiously stabilizing environment. After nearly two years of rising cap rates and buyer hesitation, conditions began to firm up in late 2025. Interest rate cuts from the Bank of Canada helped restore confidence, but investors remained selective — prioritizing tenant quality, asset resilience, and income durability.

Well-located industrial and essential retail properties continue to lead the market, attracting the most buyer attention and holding value. Office and secondary retail remain under pressure, though early signs of stability are emerging in top-tier assets.

Disclosure

This report is based on information obtained from multiple third-party sources, including Colliers, CBRE, Cushman & Wakefield, Avison Young, and Altus Group. The data presented is intended for informational purposes only and should not be solely relied upon for investment decisions. Cap rates and market conditions may vary based on specific locations, asset conditions, and economic factors. For personalized investment advice, consult with a commercial real estate professional.